Is Hiring a Public Adjuster a Good Idea? – The Honest Answer

Insurance is a tactical way to get the expenses needed for property damage repairs. After you file your claim, the insurance company sends an adjuster to evaluate the damage and decide on a payout. In many cases, the insured are content with the company’s payout.

However, unfortunately, not all insurance companies are reasonable, as many homeowners filing insurance claims in the Cape Coral FL and Fort Myers FL areas are unfortunately seeing firsthand, after Hurricane Ian. If you feel the company is giving a low payout to repair the property damage, you can hire a public adjuster. Public adjusters in Florida work to protect the rights of the insured, and not the insurance company’s side. The below excerpt illustrates why hiring one is a good thing to do.

What Is a Public Adjuster?

Before deciding whether to hire one, it is essential to know what a public adjuster does and if they are licensed. A public adjuster is a licensed person who advocates for the policyholder and settles the insurance claim on their behalf. Public adjusters are independent entities that work for the insured, not the insurance companies.

The personnel are legal in most US states, including Florida. However, it is best to consult an authoritative source before getting into the matter.

Pros of Hiring a Public Adjuster

Hiring a public adjuster can be beneficial in various ways. Here are some of the many advantages they offer. Inside this article, we breakdown all of the Pros and Cons of hiring a public adjuster. It details it all for you!

Efficient Process

Insurance policies are challenging to comprehend if you are a beginner in the field. To understand the benefits, possible risks, and alternatives, you must correctly understand the policy. Even if users somehow understand the process, they may fail to complete the standard documentation or the necessary follow-ups, leading to delays.

A public adjuster helps you craft a workable strategy, so nothing remains amiss throughout the process. They have the necessary knowledge and experience required to make authentic settlements. Moreover, since they know about the standards of insurance companies, they can help you decide which strategy will work best in your case.

Functional Insurance Claim Settlements

Hiring a public adjuster also prevents settling for an unfit payout. In most cases, insurance companies give out sufficient checks. However, many derive strategies to convince you to accept lesser payouts.

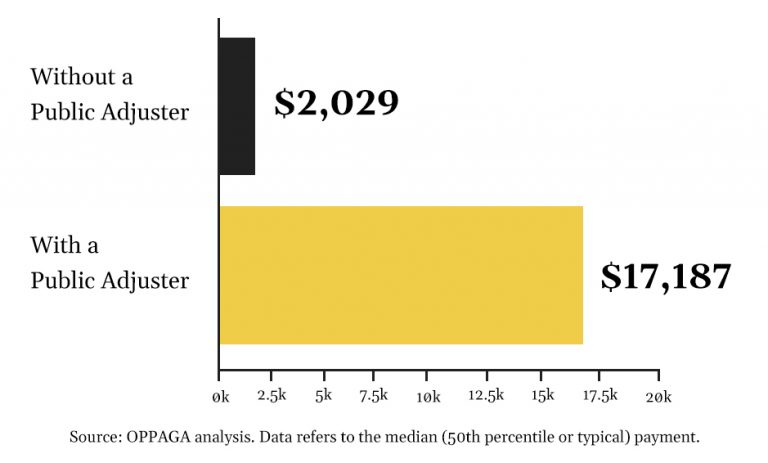

According to a study by OPAGGA, public adjusters, on average, have negotiated over 747% of insurance amounts insurance companies were willing to pay in Florida.

Hiring a Public Adjuster Saves Time

Many insurance clients are homeowners or business owners with other priorities to fulfill. Insurance claims are lengthy and time-consuming, which is not feasible for them.

A public adjuster helps organize the insurance claim procedure efficiently and provides the necessary insights that let you know the case’s progress. You can easily look after your other chores without spending too much time fidgeting with papers.

Public Adjusters are Less Expensive Than Lawyers

Lawyers are an excellent means to figure out your insurance claim problems. However, attorneys may prove significantly expensive as each attorney charges differently based on their knowledge and experience.

Public adjusters can help you achieve the same or perhaps better results in an affordable and less stressful way.

Public Adjusters Negotiate for Your Best Interests

There are different kinds of insurance adjusters. Some work for insurance companies and negotiate with clients on the company’s behalf. However, public adjusters negotiate on ‘your’ behalf and represent your side of the insurance claim dispute.

Negotiating is difficult, especially when you are stuck in a room with an expert on a topic. The results are often ineffective due to a lack of expertise. An experienced public adjuster can craft various strategies to ensure the desired results.

Detailed Documentation of Damage to Support Claim

With a public adjuster, everything from claim investigation to documentation operates smoothly. Also, you stay informed about the claim’s progress without contacting the company itself.

Working with a public adjuster is suitable for all policyholders. You can stay more involved in the process or ask them to give you a phone call when the check transfers.

No Upfront Cost

Hiring a public adjuster doesn’t require an initial fee or payment. They work your case, and you pay them when the company gives you the check. If your claim fails, you don’t have to pay the public adjuster.

Contractor Network Connections

Public adjusters have many connections to other entities in the insurance sector. With your consent, they may connect you to housing accommodation companies, insurance agents, and other persons during the process. Such links prove significant when dealing with insurance claims.

How To Choose a Public Adjuster?

Public adjusters provide numerous benefits. However, finding the suitable one requires some effort on your part. If you are considering contacting a public adjusting company, ensure the following aspects.

- How long has the company been in business?

- Have they ever dealt with situations similar to your case?

- Can they provide a licensed association to prove their authenticity?

- Is it a national or a regional association, or are they affiliated with another prominent firm?

- Do they have an in-state license?

- Are there any recommendation letters from their previous clients?

- Does the agency have enough adjusters to handle the current number of claims fittingly?

- How much involvement or transparency will be there once you hire the company’s public adjuster?

- Is the company willing to share its omissions policy?

- Does the company have a legit website?

Who is Noble Public Adjusting Group?

Since finding the right public adjuster requires effort, a recommendation proves helpful. Noble PA Group is the largest Florida-based public adjusting firm with an extended track record for delivering results for thousands of clients. Once you connect with us, you are no longer the sole fighter of the case. The entire Noble team strives to make things work.

All the tasks are performed on time thanks to efficient administration, leading to timely claim resolutions. Moreover, the knowledgeable adjusters ensure that we get you the needed settlement. With Noble Group public adjusters, you can effortlessly carry on with your other priorities as specialized persons handle the work for you.

Final Verdict

Hiring a public adjuster is a good measure when dealing with insurance claims. They help you resolve the claim adequately without an initial upfront. Moreover, since they are licensed to serve the public, there is no worry about any law inquiries after you hire one.

However, before hiring one, you need to ensure certain aspects. For instance, inquiring about the company’s experience and their resolved claims. Although most US states have legalized public adjusters, it is best to ensure that the adjuster has an in-state license.

Lastly, if you are looking for an unfailing and versatile public adjusting group, you can always connect to Noble Group. Call us at 941-655-9538 or fill out the contact form below!

Enlist Florida's Best Reviewed Public Adjusting Firm for Your Hurricane Ian Insurance Claim

I began my investigation and came across Noble Public Adjusting Group. I read the evaluations and decided to contact Tommy Browning; it was the finest decision I'd ever made; from the beginning, Tommy Browning was very professional and attentive, communicating with me at every stage about what was next or what to expect.

We received a check in the mail this week for the maximum coverage of our insurance; we are still astonished because we were not anticipating the entire amount. Thanks Noble!!!

WtApp>>>>> +16574647879

e-mail>>>>> [email protected]

contact her via:

Email: [email protected]

Whatsapp: +16574647879

whatsApp: +1 (925) 587-4914 EMAIL:[email protected]

I want to thank Noble PA group for assiting me with my hurricane claim. Although they could not assist further than a consultation Tyler Spalding was phenomenal. Tylers knowledge astounded me, at all times he was professional and courteous. I had spent months talking to my insurance company trying to get a direct response on why my policy wouldn't cover my damages. Within 2 days he reviewed my policy and gave me answers. The best part he never tried to sell me anything, or rope me into a contract. One word sums it up. Integrity.

Email: [email protected]

WhatsApp: +13523292265

Aerial handled everything flawlessly.

My wife and I could not be happier with this experience.

Highly recommended!!

Bob & Rita Potomski

I sincerely appreciate your efforts for helping me trading my $500 into $6,500

In just 6 working day's. and have been making successful withdrawal weekly, That's was awesome and unbelievable too. Now I see why everyone recommended you everywhere on Facebook no hidden charges so smooth . God bless you and strengthen you to do more for your clients ijn...

Contact Mrs Donald Maureen if you’re interested to trade and earn money through forex/Bitcoin investment.

Email: [email protected]

Whatsapp NO : +1 (563) 279-4193

Kelley

Pensacola FL

WhatsApp: +13523292265

Email: [email protected]

Thank you Daniel for everything…..We so appreciate everything you have done!

- Rachel Galione

The Best Public Adjuster in Florida

Noble Public Adjusting Group is the most reputable public adjusted groups in Florida, with a long track record for delivering results for thousands of clients. They fulfill all the requirements of an effective adjuster that we have mentioned above. They have an incredible track record of successfully working for many clients. They enable you to get more settlements on your insurance just like they claim. You can visit their website for further details of their services where you can also find their contact information.

Check Out Our Reality TV Show, “Insurance Wars”

A lot of what we do appears on our hit TV show “Insurance Wars”. We created this show to shed light on the actual battle between the insurance adjuster and the public adjuster to settle a claim for our clients. “Insurance Wars” allows clients to share their personal stories of their life being turned upside down after being affected by natural disasters, and in desperate need of help and advice. The misconception of public adjusters gets proven false time and again after Noble interjects the expertise and knowledge our employees provide.