How much does a public adjuster charge in Florida?

As Noble Public Adjusting Group continues to respond to all of the insurance claims coming in from Southwest Floridans in the aftermath of Hurricane Ian, one of the frequently asked questions we get is: “How much does it cost for public adjuster services in Florida?” To answer that, a few key points need to be touched on for proper context and clear understanding.

As the claim assessments continue coming in from the Hurricane Ian impacted zones, especially the highly impacted areas of Cape Coral FL and Fort Myers FL, the first thing that should be noted is that our services are contingency based. Meaning, our fee doesn’t apply until we have successfully negotiated payments to be disbursed from your insurance company. We don’t get paid until the insurance company has rendered your settlement checks for payment. Our fee applies to the insurance proceeds, so you are not coming out of pocket. The fee is contingent upon our ability to negotiate insurance funds to be released to you.

As the claims from Hurricane Ian begin to be submitted, the insurance companies will start to pay them out, as they should. However, be prepared, because there may be a discrepancy between what the claim is supposed to pay out and what the insurance company ends up paying out in actuality.

There are even times when the claims can be outright denied by the insurance companies. The truth in most cases is that it’s in the insurance company’s best interest to pay the minimal amount for the claims, as they are a for-profit business. There’s nothing worse than having a claim denied when you are working hard to get the money to fix up your home, especially after a natural disaster. A denied claim is yet another hurdle on your road to recovery and fighting the insurance company on your own is a complex, uphill battle. Your top priority is to hire quality professionals to rebuild your home so you can get back there and out of your temporary accommodations as soon as you possibly can. It can be very difficult to wait for the claims department at an insurance company to resolve your case and disburse your funds while your life is disrupted so dramatically. A public adjuster can help expedite and improve the process.

How much will a public adjuster charge in Florida?

The fee charged by a public adjuster can vary, and it always depends on the severity of the case. Considering that Florida is under a State of Emergency Declaration, particularly all of Southwest Florida from Hurricane Ian, it will be very straightforward. The fee is capped at 10% on the insurance proceeds for residential, and as mentioned above, it is strictly based on contingency. We won’t be getting paid until we have successfully negotiated funds to be released from your insurance company and they have officially rendered you a check. A 10% (residential) fee is applied to the amount of each check, as they get disbursed, as often times these checks are issued in multiple chunks. The reason there may be multiple checks is because there will be layers of the coverages within your policy and we are fighting for each layer of your policy to get you what you are due, contractually, coverage by coverage. Each time we reach a dispute resolution, we ask the insurance carrier to issue the funds so that you can begin the rebuilding process.

Why use a public adjuster?

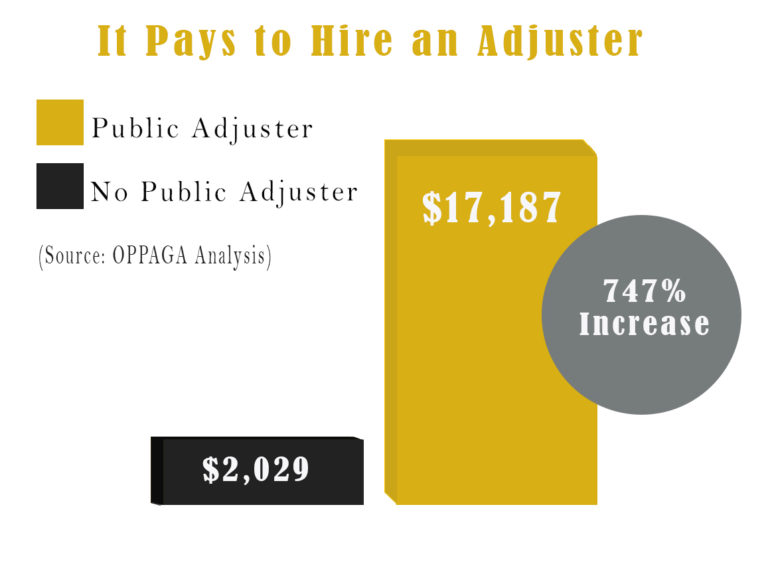

We have an excellent breakdown of the pros and cons of using a public adjuster here. While that article does an excellent job of delving deep into the details and is a great read, we want to focus in and get you to straight to the point. In short, the biggest takeaway is that when you use a public adjuster, you will have an advocate for you that is in the business of representing the claim in the most favorable light from your side of your policy. The insurance company will certainly be looking at the policy from their side and will be seeing only their interpretation of what you are due. By bringing Noble on for your insurance claim, you are evening the playing field when it comes to resources and insurance claim experience to take on the very well resourced insurance carriers. So while you focus on rebuilding what needs to be rebuilt, you can have one of the most reputable and experienced public adjusters in the state of Florida on your side. We will handle the entire the claims process and work tirelessly to get your money disbursed to you. Since many public adjusters work on a percentage of the claim basis, your interests and theirs are completely aligned when it comes to getting the most money possible from the insurance companies, especially during this natural disaster.

Just make sure that if you go with a public adjuster, which is always an excellent idea, that you hire a trusted one that is certified and licensed in the state of the claim. You can always ask a public adjuster to present the license, and we will be happy to show you that when you work with us. Our goal is to work diligently to get you the most distribution on your claim. We’re ready to do right by you.

Don’t go at it alone

You’ve probably got hundreds of things running through your mind after the immediate disaster has swept past you and your home and you don’t need to navigate alone through paperwork, policies, and fine print. After all, you already know that paying up for home insurance as a policyholder means you at least get coverage for natural disasters that are out of your control. When you hire Noble Public Adjusting Group to represent you, and your best interests, you are enlisting the largest, fully staffed, and local team of experienced public adjusters fighting on your side to get you the insurance settlement you are entitled to.

Check Out Our Reality TV Show, “Insurance Wars”

A lot of what Noble Public Adjusting Group does appears on our hit TV show “Insurance Wars”. We created this show to shed light on the actual battle between the insurance adjuster and the public adjuster to settle a claim for our clients. “Insurance Wars” allows clients to share their personal stories of their life being turned upside down after being affected by natural disasters, and in desperate need of help and advice. The misconception of public adjusters gets proven false time and again after Noble interjects the expertise and knowledge our employees provide.

Enlist the Best Reviewed Public Adjusting Firm in SW Florida to Work on Your Hurricane Ian Insurance Claim

I began my investigation and came across Noble Public Adjusting Group. I read the evaluations and decided to contact Tommy Browning; it was the finest decision I'd ever made; from the beginning, Tommy Browning was very professional and attentive, communicating with me at every stage about what was next or what to expect.

We received a check in the mail this week for the maximum coverage of our insurance; we are still astonished because we were not anticipating the entire amount. Thanks Noble!!!

WtApp>>>>> +16574647879

e-mail>>>>> [email protected]

contact her via:

Email: [email protected]

Whatsapp: +16574647879

whatsApp: +1 (925) 587-4914 EMAIL:[email protected]

I want to thank Noble PA group for assiting me with my hurricane claim. Although they could not assist further than a consultation Tyler Spalding was phenomenal. Tylers knowledge astounded me, at all times he was professional and courteous. I had spent months talking to my insurance company trying to get a direct response on why my policy wouldn't cover my damages. Within 2 days he reviewed my policy and gave me answers. The best part he never tried to sell me anything, or rope me into a contract. One word sums it up. Integrity.

Email: [email protected]

WhatsApp: +13523292265

Aerial handled everything flawlessly.

My wife and I could not be happier with this experience.

Highly recommended!!

Bob & Rita Potomski

I sincerely appreciate your efforts for helping me trading my $500 into $6,500

In just 6 working day's. and have been making successful withdrawal weekly, That's was awesome and unbelievable too. Now I see why everyone recommended you everywhere on Facebook no hidden charges so smooth . God bless you and strengthen you to do more for your clients ijn...

Contact Mrs Donald Maureen if you’re interested to trade and earn money through forex/Bitcoin investment.

Email: [email protected]

Whatsapp NO : +1 (563) 279-4193

Kelley

Pensacola FL

WhatsApp: +13523292265

Email: [email protected]

Thank you Daniel for everything…..We so appreciate everything you have done!

- Rachel Galione