States all across our nation are making it illegal for contractors of any type to negotiate insurance claims

for policyholders. Recently there have been arrests made in the state of Florida and Texas, with harsh punishments to the extent of serious jail time and thousands of dollars in fines.

As a rule, policyholders would come out better on their claims when contractors would call up the insurance company and let them know that their pricing was off and that the payout offered just wasn’t cutting it. But things have changed and the insurance companies aren’t playing around when it comes to this offense. If you’re a contractor of any type, whether it be a roofer, plumber, mold remediator, water mitigation company, or other, don’t let this new oppression discourage you. You have a friend in the business of Insurance work. Public Adjusters can legally negotiate the claims for the policyholders that are your clients. As a matter of fact, it would do you well to have an associate like Noble Public Adjusting Group that you can call on for every insurance job you bid on. Let me explain why you need us…

When Noble Public Adjusting Group represents a policyholder, it is standard to increase the claim astronomically. How do we do this? Well, we just so happen to know tons of state statutes, case law, code upgrades, and a multitude of “Insurance Goodies” that force the insurance company to fully compensate an insured for their damages. Instead of only small portions being repaired leaving the policyholder in a “patchy”, half-done situation, we can often get the entirety of the problem replaced. This results in brand new roofs as opposed to replaced shingles here and there; or a brand new hardwood floor, instead of a mismatched new section placed with an aged floor, causing that patchy look. These are just a couple of examples of how we increase a claim. What does this do for you? Well, naturally it makes for a larger job, not to mention we get the appropriate pricing along with overhead and profit, if applicable.

Another way we can tremendously help contractors is by eliminating the competition. We do this two different ways.

First: We give our associates direct referrals and leads. Most of the time when a policyholder calls on Noble to file their claim, they have not chosen a contractor, remediator, or other to restore their damages. They almost always ask for a referral from us, because we deal with this on a continual basis.

Second: You win the bidding. There are two main reasons for this:

A.) Instead of having the old-fashioned bidding war, you simply offer a contract per “Fair Insurance Proceeds”. The policyholder is ecstatic that you’ll do the job and only ask for what the insurance company will pay, because it means no additional cost out of pocket for them. How does this help you? That’s where we come in. We increase the claim payout substantially, which means instead of you getting paid what your low bid would have been, you make the higher amount that we negotiate and settle for.

B.) You can offer the services of an Insurance Advocate to them:

- A free claim inspection, policy review, and consultation from an insurance expert (Noble Public Adjusting Group)

- An associate team of Insurance Professionals to guide them through and answer questions throughout the claim and restoration process

- Filing of the claim and ALL paperwork, negotiation of the claim, and full representation for the duration of the claims process (taking on essentially ALL of the hassle of dealing with the insurance company) for a small percentage of the claim.

- All of this for absolutely NO money upfront and we work on contingency, to be paid AFTER the insurance company pays the claimant.

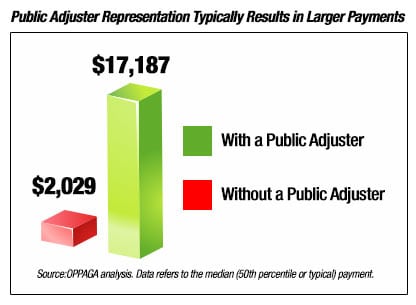

Did you know that Public Adjusters get 747% higher payouts (on average) for policyholders than they get on their own? A study conducted by Oppaga (the government entity) proved this when looking over just one insurance company’s claims. You can see on the graph to the left that for example; when a policyholder files a claim on their own, they receive a payout of about $2,029.00. When they used a Public Adjuster the claim payout, on the same claim, was around $17,187.00. See full Oppaga report here. This is about the average increase we see on a daily basis. Now, can you do more with two thousand dollars or with seventeen thousand? This is an important statistic for you to know for your own business, but also to show to your customers. We at Noble have brochures and marketing materials that you can keep on hand to give to your customers, if they would like to see things like this to help them understand the value of using Noble. We also have materials geared toward contractors for your own records and to hand out to your colleagues.

What does Noble get out of this?

Referrals. You simply return the favor by referring your insurance jobs to us. We make a percentage of the claim and our name gets out there one person at a time. We do not charge you to be our associate, we just help one another by giving business to each other. Noble is totally compliant with the state. Our company is based on integrity. We win our negotiation battles with legitimate points and tools, so you can feel confident that we are honestly helping the property owners and each other. If you have more questions about becoming an Associate, please don’t hesitate to call and schedule a consultation.

Noble offers Insurance Appraisal Services nationwide and P.A. Representation in the states of Florida, Georgia, and Texas. Check out our reviews online or call for an extensive list of references.